This research underlines the gap between concept and delivery, highlighting an industry still in transition towards a more commercial, business-oriented model. While the introduction of finance experts and changes to lawyer remuneration indicate the direction of travel, access to the required financial data is far from ubiquitous. This not only raises very real concerns about firms’ ability to minimize write-downs and achieve cash recoverability goals but shows just how far firms must progress before they have access to the information required to demonstrate deeper client value.

Firms, for example, are not demanding the regular, frequent financial information that is essential to provide both a complete view of performance and insight into trends that may need rapid intervention. When asked how often the firm is asked to report on financial information, billings data is requested 2-3 times per month for 21% NA, 28% UK firms; while cash recoverability data is required 2-3 times per month in 27% NA, 28% UK firms.

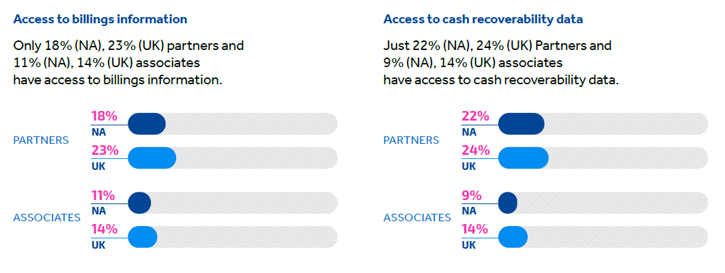

Furthermore, partners and associates still have extremely limited access to data. Only 18% NA, 23% UK partners and 11% NA, 14% UK associates have access to billings information; while 22% NA, 24% UK Partners and 9% NA, 14% UK associates have access to cash recoverability data.

How are these individuals expected to embrace a more commercial attitude towards client engagement without any understanding of the financial metrics? Incentives will make no difference to performance if individuals have no information to support vital, day-to-day decision making.

Another pressing concern is that this information is not up to date, with the mean value for billings data age at 2.83 days (NA) 3 days (UK), and cash recoverability data 3.06 (NA), 3.18 days (UK). By the time the data is reported to partners and associates, it could be too late to make the optimal commercial decisions. Only a small minority (10% NA, 15% UK) have access to billings data and (10% NA, 10% UK) cash recoverability data less than 12 hours old.

To add to this, visibility of profitability is also a concern, reinforcing on-going issues facing firms as discussed in the BigHand Pricing and Budgeting Report which revealed that just 23% of partners in NA and the UK, and only 11% of associates in NA and 12% of associates in the UK, have visibility of profitability data. How are firms going to improve profit margins if individuals are not supported with actionable information?