Plugging the Gaps

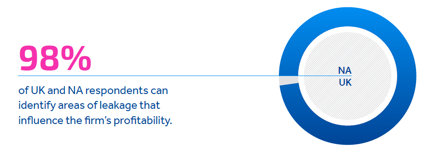

Over 98% of firms in NA and the UK experience areas of profit-leakage that influence the firm's profitability – and they plan to take steps to plug the gaps over the next two years. The priority is to improve the visibility of financial data (28% NA, 29% UK), underlining a growing recognition that firms need better, faster, trusted insight into KPIs if they are to achieve any long term, sustainable reductions in lock-up / inventory.

Improved insight will be supported by the creation of new policies and processes designed to achieve a far more consistent, firm wide approach to financial client interactions that should unlock additional profit. Firms plan to review billing write-offs /downs (24% NA, 25% UK), standard rate discounts (21% NA, 25% UK) and collection write-offs / downs (26% NA, 21% UK).

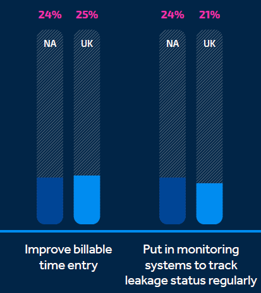

In addition, firms (24% NA, 25% UK) plan to improve billable time entry, while 24% NA, 21% UK will put in monitoring systems to track leakage status regularly.

The speed with which firms make these changes will be key given the inflationary pressures affecting the global economy. While plans to downsize office premises in response to the growing demands from employees for hybrid working will mitigate some of the cost increases, wage inflation alongside sign-on incentives and bonuses - is now accepted as a significant issue.

Rising interest rates and the cost of creating net-zero environmental strategies are contributing to a very different law firm cost model, reinforcing the importance of understanding profitability and imposing far better control through real-time monitoring.

Wider Implications of Cost Rises

Increasing staff costs also play directly back to client demands for work to be completed by the most cost effective resource, highlighted in the BigHand Resource Management Report. Without immediate visibility of the changing cost base across the organization, firms will be completely blind to the escalating costs and the profit implications.

How can firms accurately price work? How will firms identify if certain departments or matter types are experiencing stronger cost pressures or incurring higher levels of write-offs or client disputes? Law firms are entering into a new commercial landscape, and fast access to accurate data will be essential if firms are to keep on track with profitability goals.

This was an excerpt from The Legal Cash Flow Report. Access the full report to dive deeper into the findings from over 800 legal management professionals: