Aged Debt v Aged WIP

Given the push back from clients, it is interesting to note the impact of the pandemic on cash recoverability measures. A year ago, the BigHand Cash Flow and Profitability report 2020 asked respondents: ‘Which areas of lock-up/inventory do you believe has the biggest effect on your firm’s cash flow?’. In the UK the problem lay mainly with Aged WIP (51%), rather than Aged Debt (37%); while in the US, Aged Debt 53% was a more pressing concern than Aged WIP (28%) – suggesting that US firms had already made some of the cultural changes required to address cash tied up in WIP, such as improving profitability awareness among lawyers and increasing billable time entry.

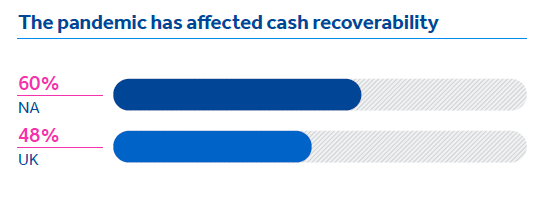

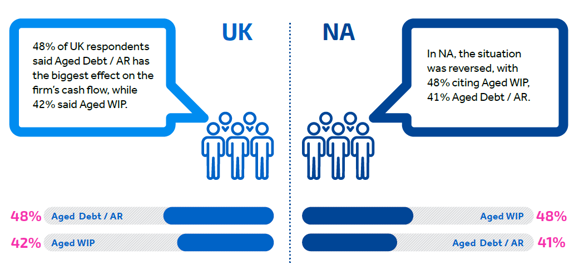

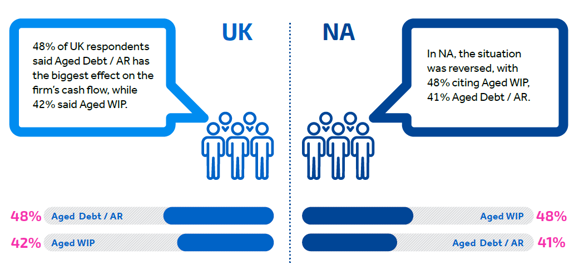

This year’s research, however, reveals a slightly different picture – although the challenges remain severe. Almost half (48%) of UK respondents said Aged Debt is an area of lock-up / inventory which has the biggest effect on the firm’s cash flow, while 42% (UK) said Aged WIP. In NA, the situation was reversed, with 48% citing Aged WIP, 41% Aged Debt. These findings underline the challenges not only in traditional cash management but also the new issues created by the pandemic – from client financial demands to the disconnect of dispersed teams working from home, finance teams have to consider new factors that are influencing working capital.

Supporting a Hybrid Workforce

While firms have clearly wrestled with multiple issues during the pandemic, how many have considered the pressing implications of new working models and client demands on cash recoverability? The delays in clients settling bills referenced above are adding to Aged Debt, particularly in the UK. While NA firms have also experienced this delay, it is likely that the work already undertaken to improve Aged Debt recovery, by improving billing processes and visibility, is helping firms to prioritize and address the biggest areas of concern.

The rise in significance of Aged WIP for NA firms could be another side effect of lawyers working from home, without direct access to secretarial support, feeling compelled to complete more administrative tasks. As discussed in the BigHand Workflow Management Report, lawyers are having to spend more time on low value work due to the reduction in support staff and the lack of good processes for allocating work to the right support resources when everyone is working remotely.

In addition to impacting billable hours, this is a hugely inefficient approach that will be far more expensive than using the correct support team resource. Individuals who are experts in these administrative processes do them faster, more efficiently and more accurately.

Any strategies already developed to reduce working capital must now be reviewed within the context of hybrid working and access to dispersed support services. Effective task delegation will ensure lawyers have direct access to the support required; while better information and processes will also be vital to minimize the time spent on non-billable hours, meet client demands for transparency and enable lawyers to make fast, accurate decisions and focus activity.

The pandemic has confirmed the fragility of global economies and the need for higher levels of capital contingency. As the post-pandemic commercial marketplace evolves, the new financial pressures cannot be ignored. Firms need to have a far better understanding of both working capital and how changing client demands and rising costs are squeezing profitability. Robust, long-term plans are required to achieve sustained change and safeguard profitability.

This was an excerpt from The Legal Cash Flow Report. Access the full report to dive deeper into the findings from over 800 legal management professionals: