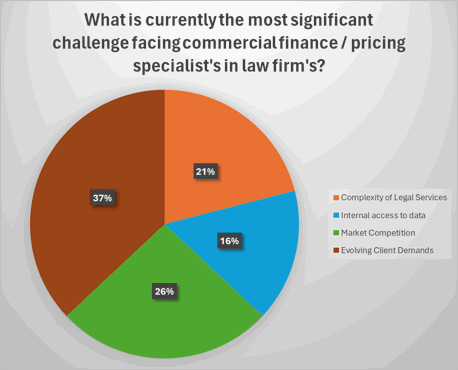

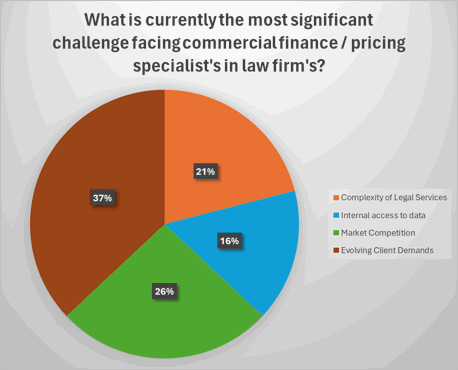

Having recently conducted a LinkedIn poll inquiring, ‘What is currently the most significant challenge facing commercial finance and pricing specialists in law firms?’ evolving client demands emerged as the clear winner with 37% of the votes.

Tailor-made Legal Services

Conversations with legal pricing specialists reveal a growing trend of clients are seeking tailored-made legal services, making it necessary for law firms to adapt their pricing models to accommodate bespoke requests, complicating the establishment of standardised pricing structures. Clients are increasingly seeking greater transparency in fee calculations and potential cost overruns, despite the inherent complexity of the provision of legal services. Many clients are also expressing in exploring alternative fee arrangements such as fixed fees and contingency fees. This evolving landscape demands pricing strategies that offer flexibility and align cost with perceived value, pushing law firms to be responsive to clients’ price sensitivities.

Surprisingly, and perhaps counter-intuitively, the challenge that received the fewest votes when evaluating pricing challenges in law firms, with only 16% of respondents selecting it, is the most frequently cited as a source of frustration by candidates contemplating job changes. Interestingly, the issue of internal access to data was a predominant theme at the Big Hand 2023 conference where several seminars highlighted the critical role of powerful data insights in financial and operational management. The persistent issue of limited access to accurate, up-to-date, and historical data is a consistent concern for candidates looking for a new opportunity. This often leads candidates to seek employment with firms possessing these capabilities.

The accuracy and completeness of internal data may vary, potentially leading to mistakes in pricing strategies and ultimately adverse financial consequences. Moreover, the availability of accurate historical data is crucial for creating informed pricing strategies. The absence of tools and processes for capturing and analysing past pricing data can hinder the learning from prior pricing experiences. Additionally, integrating data from diverse sources within a law firm, including various practice management, billing, and document systems, can prove technically challenging, demanding substantial effort for data aggregation and analysis.

A Holistic Perspective

In Dee’s view, improved data insights offer a significant opportunity to improve decision-making and provide law firms with a better understanding of evolving client demands in the long term. This data-driven knowledge offers a holistic perspective on a firm’s operations, client interactions, and market trends. As data insights improve over time, law firms can increasingly understand their clients’ preferences, behaviours, and needs. This evolving dataset will empower business services staff to adeptly customise their services and strategies to effectively meet client expectations.

During recent pricing function hires which Totum have assisted, it is evident there has been a shift to a more strategic drive within pricing functions and the desire to employ pricing professionals to develop adaptive pricing models with a primary emphasis on meeting the demands for value and adaptability. This shift emphasises the importance of maintaining competitiveness whilst also nurturing strong client relationships and deep sector expertise and will only be achieved with data insights.

Dee Deol is a Legal Finance Recruitment Manager at Totum Partners, a leading business services recruitment firm with a focus on law and professional services firms. Dee has placed a number of pricing and commercial finance professionals and his expertise and experience in this area enables him to offer valuable insights and guidance to clients on how to build and expand their commercial finance teams within the legal and wider professional services industry