Firms are driving lawyers hard to increase billable hours – but lawyers, especially the next generation, don’t want to work more hours. With write-offs increasing, firms that improve billing processes and client communication – rather than relying on offsetting them - will increase profitability without risking a loss of key staff.

Discounting and Write-Offs

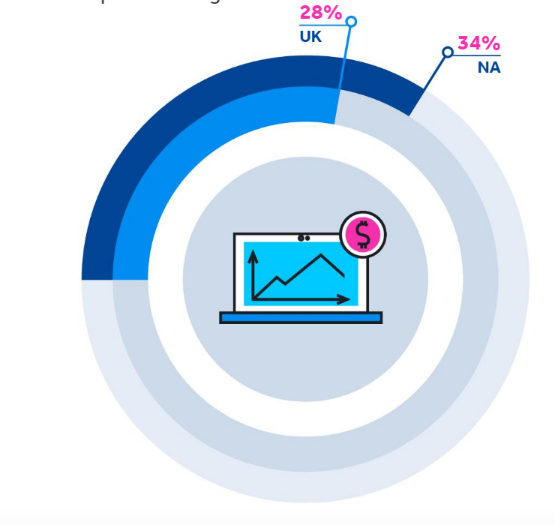

The most effective way to safeguard profitability is to reduce leakage – but to do so firms need to identify the biggest problem areas. Over a third (34%) of NA firms (28% of UK) confirm that standard rate discounts remain the most significant cause of profit leakage. This is up from 25% of NA, but down from 30% of UK last year, suggesting NA firms are currently facing greater price pressures than their UK equivalents. This is closely followed by billing write-offs/downs (32% of NA and 27% of UK).

The speed with which write-offs have increased this year should be sounding loud alarm bells. Not only have 75% of NA and 64% of UK firms confirmed an increase this year, but 55% of NA and 48% of UK firms confirm that write-offs have increased by more than 10%. With clients putting pressure on for more information, any firm with inadequate financial transparency will suffer.

Over a quarter of firms (27% of NA and 26% of UK) are also discounting to collect payment – down just slightly from 29% of NA and 30% of UK last year. However, while this was a strategy that made sense during the early days of the pandemic when firms committed to supporting the client base, it should be raising eyebrows at top level now.

Information Shortfall

Where is the justification for the discount or write-off? Is it down to the personal view of the partner or lawyer, or is there a consistent, firm-wide approach? In many cases, firms are playing into the hands of clients by failing to adequately demonstrate the work undertaken.

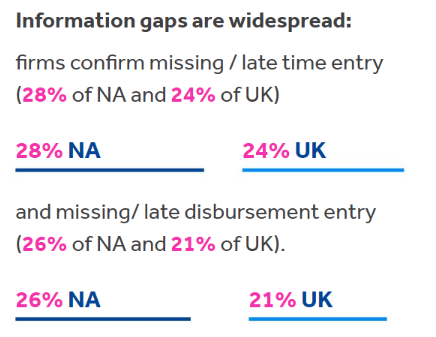

Information gaps are widespread: firms confirm missing / late time entry (28% of NA and 24% of UK) and missing/ late disbursement entry (26% of NA and 21% of UK). As a result, too many firms are leaving themselves wide open to client demands for discounting and write-offs because they cannot prove the work done on each matter.

On the plus side, while firms admit to poorly scoping work up front or not agreeing the scope with the customer (14% of NA and 16% of UK) and not using the right level of resource to complete phases and tasks (10% NA and 12% UK), this is an improvement over last year’s performance. In 2021, 23% of NA and 25% of UK firms admitted to poor scoping of work up front and 22% of NA, 22% of UK to not using the right level of resource. The reduction in the numbers this year indicates that firms are improving client communication and making better use of resource allocation tools to achieve better resource utilization.

Improving Processes and Information

Firms are highly aware of the causes of profit leakage and have plans in place to improve processes. It is notable, however, that NA firms are more committed to improvements than those in the UK. This is likely a reflection of the additional pressure currently being placed on NA firms by clients, as highlighted above, and the resulting higher levels of write-offs.

Firms are responding to the need to improve information resources. Over a third (37% of NA) and 26% of UK firms plan to improve billable time entry over the next two years, while 36% of NA and 24% of UK% will improve financial data visibility to gain insight into the issues that are leading to profit leakage.

In addition to creating a better information resource, firms recognize the need to develop and enforce consistent processes. Almost a quarter (22%) of NA and 26% of UK will review standard rate discounts, which should ensure individuals adhere to a corporate policy. In addition, 26% of NA and 21% of UK are looking at billing frequency which will help both firms and clients in understanding the accrual of costs.

Firms also want to review collections write-offs/downs (22% of NA and 19% of UK) and billing write-offs/downs (19% of NA and 18% of UK) to understand the causes of these escalating problems. By combining the timeliness of billing with better information about the cost and triggers for discounts and write-offs, firms can gain far greater insight into the true profitability by client and matter. They will also gain early warnings of potential problems that should prompt timely and insight driven client dialog.

Profit Goals

To achieve this level of commercial discussion, firms also intend to improve staff understanding and focus on profitability.

Plans include training fee earning staff in pricing practices (21% of NA and 20% of UK) and recruiting a pricing specialist (22% of NA and 17% of UK). This shift in firms’ expectations of lawyers is further underlined by the widespread increase in billable hours targets. Almost all firms (96% of NA and 98% of UK) have increased the target billable hours for lawyers – with 44% of NA and 47% of UK firms confirming the target has increased by more than 10%.

Is this a knee jerk response to the endemic salary rises? Or simply a cover for bad financial control, for poor processes that lead to both lost collections and client conflict? A lack of matter budgeting (33% of NA and 26% of UK) and underpricing work initially (30% of NA and 28% of UK) are cited as key causes of profit leakage – and will also contribute to client conflict and write-off.

Simply piling pressure on lawyers to bill more hours is a risky business – especially without the right processes and information to ensure those hours are profitable or that client relationships are maintained.

Talking Points

Law firms could improve both profitability and client relationships by robustly addressing the causes of profit leakage, rather than focusing so heavily on increasing billable hours. As firms face up to the undoubted challenges of the next 12 to 24 months, the pressure to embrace a more commercial business model will increase. But there is a huge difference between driving lawyers to bill ever more hours – potentially to the detriment of both employees and clients - and empowering them with the right information and support to ensure those hours achieve maximum profit.

Firms need to think hard about the way in which the new commercial culture is created not only to safeguard profitability but also to ensure they hold on to both high quality lawyers and valuable clients as and when the market improves.