The pandemic has created significant challenges – but coming so soon after the last financial downturn (2007 -2012), many senior individuals will be aware of the possible business implications. During the last recession, discounts, write-downs, and write-offs kept net prices flat for nearly six years – and no one wants to repeat that experience.

So far, firms have managed to maintain Profits per Equity Partner (PEP): 78% (NA) and 75% (UK) firms say PEP has either increased or stayed the same over the past 18 months. While many firms experienced an initial surge in client demand for legal support at the beginning of the pandemic, the decision to impose rigorous cost controls over the past 18 months has played a significant role in maintaining PEP.

Cost Control

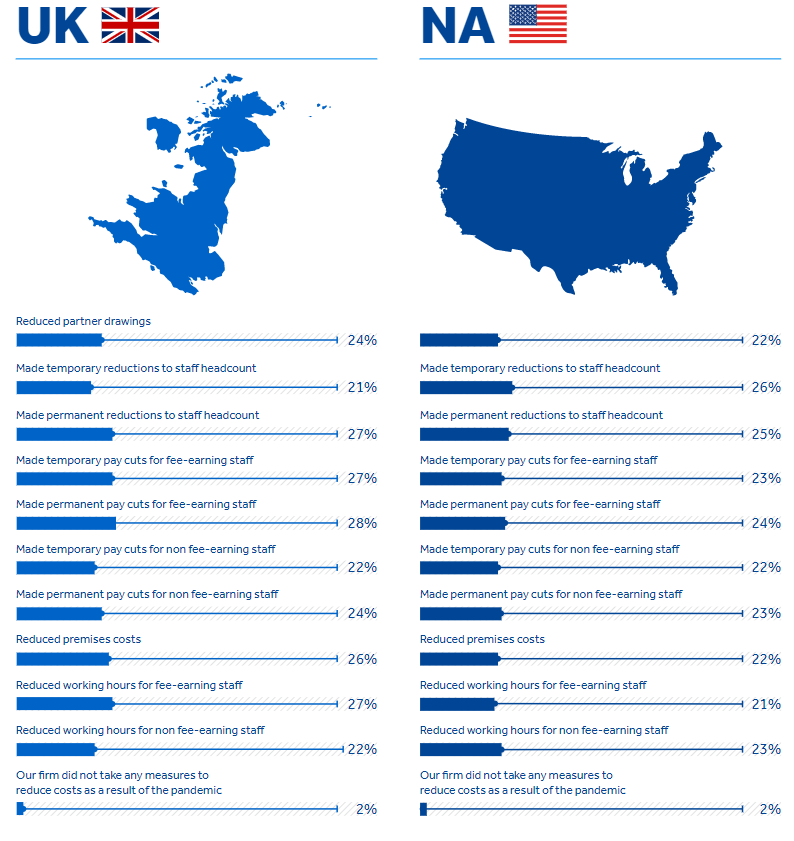

The research confirms that firms across the board (98% NA and 98% UK) took radical steps to control costs at the beginning of the pandemic. In addition to a cut in premises costs (22% NA, 26% UK), many firms have taken stringent actions to reduce staff overheads. Significant permanent and temporary reductions in headcount, hours, and salaries have been imposed by firms to gain greater control over the cost base.

Working hours were reduced for both fee-earning (21% NA, 27% UK) and non fee-earning (23% NA, 22% UK) staff. Firms also made permanent (25% NA, 27% UK,) and temporary (26% NA, 21% UK) reductions to staff headcount.

Permanent (24% NA, 28% UK) and temporary (23% NA, 27% UK) pay cuts were introduced for fee-earning staff; and permanent (23% NA, 24% UK) and temporary (23% NA, 22% UK) pay cuts for non fee-earning staff. 22% (NA) and 24% (UK) have reduced partner drawings.

What measures did your firm take to reduce costs as a result of the pandemic?

Planning for Growth

These stringent measures enabled firms to retain profitability during a time of crisis, but a post-pandemic economic model is now coming into play. Not only is the world beginning to transition back to office-based working practices but there is growing evidence that downsizing plans are being reconsidered. According to the 2021 CEO outlook survey from KPMG, which surveyed over 1,300 chief executives globally, four in five have no plans to cut their companies’ physical footprint post-pandemic. This is in direct contrast to the results in 2020 when 69% of global leaders were planning to downsize.

The focus now is on growth, with economic confidence encouraging almost nine in 10 senior executives to plan acquisitions over the next three years. To sustain this growth, firms will likely need to reverse many of the cost-cutting measures – not only office space but also reinstating staff hours and rehiring staff. With the well documented challenge in recruiting talent, salaries for even the youngest lawyers are rising fast – with junior lawyers now tipping the $200,000 mark in NA, and £147,00 in the UK according to Legal Cheek.

Costs are inevitably creeping upwards, how will firms maintain the level of profitability achieved during the pandemic? Is it likely that the upward PEP trend can continue if firms do not get control over the rising levels of write-offs and a drop in billable hours? Plus, with clients becoming ever more demanding and professional procurement teams playing a bigger role in decision making, firms need to be proactive and find a way to change the conversation and demonstrate value upfront.

This was an excerpt from The Legal Pricing and Budgeting Report. Access the full report to dive deeper into the findings from over 800 legal professionals: