Scattergun Approach to Cash Realization

When asked what projects, if any, the firm plans to introduce, as a priority, to reduce lock-up / inventory in the next two years, 100% NA, 99% UK firms have plans to address the problem. However, the results reveal quite different priorities and a scattergun approach which underlines both the difficulties firms face in unlocking cash and the lack of a best practice model in this area.

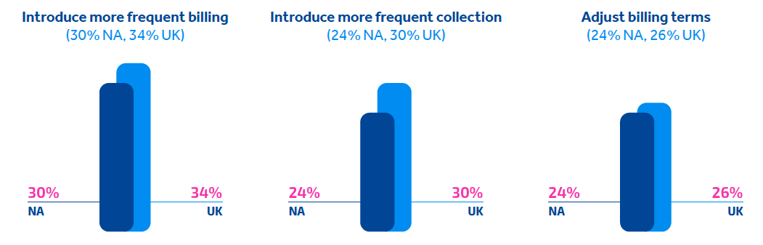

Firms are looking to change operational processes and evolve the corporate culture to better support client expectations. A reactive approach is to introduce more frequent billing (30% NA, 34% UK), more frequent collection (24% NA, 30% UK) and adjustment to billing terms (24% NA, 26% UK). These are short-term changes that do not address the cultural and operational changes required to achieve a long-term reduction in working capital.

More significant cultural change is on the cards – with lawyers expected to improve billable time entry (25% NA, 26% UK). In addition, firms plan to create new processes for write-off approvals (29% NA, 28% UK), ensuring all decisions are made in line with corporate policies, not individual client/ lawyer preferences.

There are also plans to improve visibility of lock-up / inventory to partners and management (28% NA, 32% UK), as well as the introduction of new monitoring systems to track lock-up / inventory status regularly (25% NA, 32% UK). In addition, (30% NA, 32% UK) plan to improve client communication throughout the matter to limit surprise bills and avoid the payment delays and write-offs associated with disputes.

Data Capture and Visibility

Operational and cultural changes are required if firms are to address both Aged WIP and Aged Debt problems. This diversity in approach, however, underlines the lack of robust systems and data in place to support better processes. With enhanced information capture and visibility, firms can proactively manage and control the situation – for example by automatically enforcing write-off and discount policies. Lawyers have far better insight into clients’ payment history, highlighting any delays and allowing individuals to directly address any concerns before disputes arise that could lead to write-offs.

Furthermore, with the correct information model, firms can automatically provide clients with the routine, accurate information they now expect, minimizing the problems associated with poor transparency and providing a foundation for the deeper, added value discussions that create stronger relationships.

This was an excerpt from The Legal Cash Flow Report. Access the full report to dive deeper into the findings from over 800 legal management professionals: