2021 was a year to remember, with the 100 top-grossing U.S. law firms tracked by American Lawyer reporting gross revenue growth, buoyed by high demand in M&A and other transactional work. The downside was the resulting spike in talent demand, exceptional levels of lateral hiring and record salaries.

While inflationary pressures were building last year, few law firms forecast the challenges that have arrived in 2022: the highest rates of inflation in a generation, competition for talent and office returns have contributed to double digit increases in expenses, according to Reuters[1]. The issue is not only rising costs, however. Demand is also falling, with corporate demand down by 0.7% and merger and acquisitions work down 4.9% in the second quarter of 2022.

With clients also facing the same profitability challenges, law firms need to look closely at the role of lawyers in improving working capital management. Delayed payments, discounts, write-offs, even client failure can quickly escalate during a time of recession, making it more important than ever for lawyers to keep on top of client relationships to better manage working capital.

Client Expectations

Firms also need to respond to growing client expectations for financial transparency – a trend that has escalated in recent years.

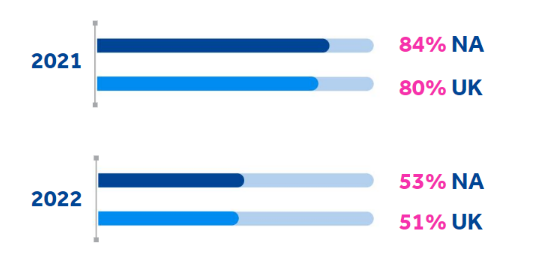

Last year we reported that 84% of NA and 80% of UK respondents had received demands from clients for greater transparency and reporting – and the trend continues. Over half (53% of NA and 51% of UK) of firms confirm they have received further increases in demand from clients for more financial transparency this year.

Client information requirements are also far more specific as attitudes evolve away from the traditional ‘trusted partner’ approach to matter management and total cost. Clients want detailed information about cost and resource allocation throughout the entire matter to ensure unexpected costs are flagged early.

This trend towards an expectation of detailed, matter level insight is stronger in NA, where 54% of firms (45% of UK) confirm they have seen an increase in demand for real-time financial matter updates from clients. There has also been an increased demand for matter budgets (50% of NA and 43% of UK), and client reporting (50% of NA and 42% of UK).

Facing client demands for such detailed insight, how much progress have law firms made in capturing this information and using it to better manage working capital?

Slow Progress

For the past two years, there has been a stark difference between NA and UK firms in their approach to managing working capital. In 2020, in NA Aged Debt/ AR (53%) was a more pressing concern than Aged WIP (28%), while in the UK the problem lay mainly with Aged WIP (51%), rather than Aged Debt / AR (37%). This trend reversed in 2021, with 48% of NA firms saying WIP had the biggest impact on cash flow; while 48% of UK firms attributed the problem to Aged Debt/AR. Clearly firms have taken steps to address the biggest pain points at the time, improving visibility of WIP and invoicing more frequently to address Aged WIP and taking steps to proactively work with slow paying clients to minimize debtor days.

In contrast, this year’s results show a more even split globally, with 39.5% of NA and 37% of UK saying Aged WIP and Aged Debt/ AR have an equal effect on cash flow. Discrepancies remain though: 24% NA and 33% UK say Aged Debt/AR is most significant, while 24% NA and 24% UK say Aged WIP. While these results suggest that some progress has been made, firms are clearly still struggling to both clarify and expedite a robust approach to managing working capital. Given the rise in pressures facing clients and the likelihood of payment delays as well as demands for write-offs and discounts in a recessionary market, firms need to improve financial visibility, especially at matter level, if they are to understand the impact of each client on the profitability of the business.

Making Changes

Firms are recognizing the importance of improving operational processes in a bid to increase working capital, with plans to introduce a number of measures to reduce Aged WIP and Aged Debt/AR. The biggest priority (40% of NA and 40% of UK) is to improve client communication throughout the matter to limit surprise bills and therefore reduce the possible disputes that can delay payment and better meet client expectations.

To achieve this, of course, requires excellent financial information – and firms plan to improve billable time entry (44% of NA and 31% of UK) and improve visibility of lock-up / inventory to partners and management (38% of NA and 32% of UK). Equipped with accurate and timely data, firms can address Aged WIP and Aged Debt problems before they become critical, improving both working capital and client relationships.

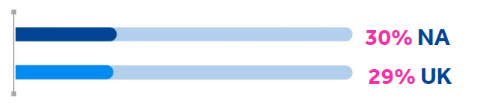

Process change is also a priority. A third (33% of NA) and 29% of UK plan to bill more frequently, to reduce the risk of clients receiving unexpected bills. 30% of NA and 29% of UK will collect more frequently, a move that should reduce debtor days.

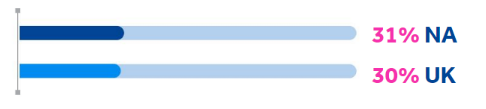

In addition, 31% of NA and 30% of UK firms are introducing new processes for write-off approvals, ensuring a far more consistent approach across a firm, and avoiding the risk of managers taking a personal decision to write-off without understanding the downstream implications.

Talking Points

The expression “What you allow when you are winning, you have to live with when you are losing” is familiar to any sporting aficionado. And for law firms, the global economic trends of 2022 are bringing into sharp focus many of the lax processes that were allowed while business was strong.

Which clients are contributing to Aged WIP and/or Aged Debt problems? Is there a consistent, firm-wide approach to and control over pricing, discounts and write-offs or are partners/ senior lawyers still given leeway to make decisions without understanding the downstream implications? If the latter, where does the buck stop when it comes to the impact on profit? And, critically, what defines a good client? A top name looks good – but if that work isn’t profitable, does that client represent sustainable business in an economic climate that demands the agility provided by excellent working capital?

This was an excerpt from the report Maintaining Profitability in a Global Recession. Access the full report to dive deeper into the findings from over 800 legal management professionals: