The shift to a truly effective commercial operation will not be achieved without providing access to timely, relevant and accurate data across the board. While progress has been made over the past few years, the level of write-offs and discounting indicate that more work is required. What are firms doing to improve payment times and ensure clients have the information they need to support a positive engagement and avoid conflict?

The vast majority (96% of NA and 89% of UK) of firms hold partners accountable for the profitability of work – although only 38% of NA and 34% of UK apply this policy every time. Yet, this disconnect between profit accountability and the lack of it being enforced consistently is perhaps understandable when only 35% of NA and 28% of UK firms have real-time automated reporting per matter. Firms need to not only be investing in technology that shows the impact of upstream decisions being made but also investing in the education of their lawyers to understand and utilize the financial metrics to improve their profit contribution.

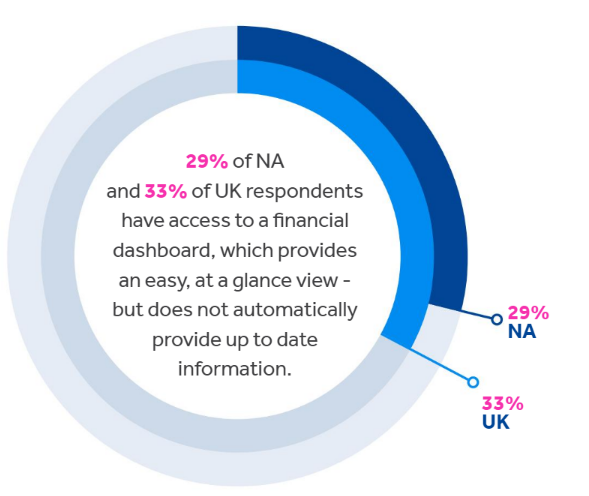

29% of NA and 33% of UK respondents have access to a financial dashboard, which provides an easy, at a glance view - but does not automatically provide up to date information. Often, pre-populated dashboards will offer a snapshot of data, which provides a trend analysis over a period of time. What is required, however, is a powerful tool that not only delivers up to date information but the ability to filter and interrogate that data and gain true insight to support both internal decision making and external client dialog.

That said, these individuals are, however, better off than those still trying to manage with cumbersome, out of date information: 40% of partners are still receiving monthly reports, 34% quarterly reports, 29% weekly reports and 27% rely on post matter analysis. How can a partner proactively manage client relationships with a commercial, profit driven objective when information is so out of date? From timely interventions to address potential payment issues to identifying areas of additional revenue, profit responsibility can only be achieved with immediate access to the right information resources.

Extended Commercial Remit

Law firms are expanding the responsibility for profit to beyond just the partners and finance teams – the entire fee earning team now has some financial responsibility. 94% of NA and 90% of UK firms encourage lawyers to have an awareness of the profitability of a matter – and over a third (35% of NA and 36% of UK) expect this awareness to be applied to every matter. It is interesting to note that lawyers have better access to real-time matter information than partners – although there is still significant room for improvement. 42% of NA and 32% of UK firms provide real-time automated reporting per matter and 32% of NA and 34% of UK have access to financial dashboards.

In contrast, however, 30% of NA and 30% of UK firms still rely on practice heads/ partners to relay this information to lawyers. Information is typically out of date – with reports provided weekly (29% of NA and 25% of UK); monthly (33% of NA and 36% of UK); or quarterly (29% of NA and 28% of UK). A quarter (23% of NA and 25% of UK) rely on post matter analysis.

How can lawyers be empowered to improve the commercial relationship with clients and drive down profit leakage without access to real-time, intuitive, usable information? Lawyers cannot achieve tangible change when reliant on historical data – they can only fire fight. It is access to immediate information that allows a far more innovative, responsive and proactive approach.

Improvement in Access and Quality of Information

Compared to last year’s results, when just 23% of the partners in NA and UK had visibility of profitability data – and only 11% of lawyers in NA and 12% in UK could see matter profitability information, progress is being made.

Improvements have also been achieved in the timeliness of reporting. Last year’s research revealed very limited access to billings data (10% of NA and 15% of UK) and cash recoverability data (10% of NA and 10% of UK) less than 12 hours old. In contrast, this year’s results show that around a quarter of law firms in both NA and UK are offering self-service access to financial information. Lawyers in these firms are now empowered to access the data they require on demand, supporting for more timely and proactive decision making.

This includes billings data (24% of NA and 26% of UK), time recording data (23% of NA and 20% of UK), unbilled time (23% of NA and 18% of UK), cash recoverability/collections (22% of NA and 18% of UK), profitability (24% of NA and 16% of UK) and Debtors/ AR (20% of NA and 15% of UK).

Information is also more up to date, with far more key data resources being updated more than once a day. Today, 67% of NA and 64% of UK firms have access to cash recoverability data that is refreshed at least once a day; and 64% of NA and 61% of UK to billings data. As a result, firms now have an up-to-date information resource that can be used to drive significant operational change and reinforce the commercial focus.

At the other end of the scale, however, laggard firms are still struggling with out-of-date reporting. Two fifths (40% of NA and 42% of UK) only receive profitability data weekly at best and, of those, 12% of NA and 12% of UK receive it once a month or even less frequently. As a result, it is no surprise to discover that these firms are failing to update their data regularly, with lawyers forced to rely on data that is at least a week out of date at best. Those firms still dependent on outdated information should be concerned – the rest of the market is making improvements fast.

Time for Actionable Insight

Firms are capturing and reporting more information – and at a more granular level – than ever before. But this report confirms that very few firms have moved towards an operational model that has embedded data in everyday decision making.

There is still a marked lack of reporting at client/ matter level, for example. Only 21% of NA and 19% of UK firms are reporting billings data and 23% of NA and 19% of UK on profitability data at client/ matter level. This is an improvement from last year, when just 8% of NA and UK firms reported on billings data and only 9% of NA and UK firms on cash recoverability data at client/ matter level. However, there is still a long way to go to support lawyers in meeting the new commercial imperatives.

Firms (99% of NA and 98% of UK) are increasingly committed to using financial data to drive tactical and strategic decisions. The emphasis remains, however, on using retrospective data to inform the future rather than the frequent use of up-to-date insight to drive immediate change and support timely client conversations.

For example, pricing information should be supporting lawyers’ day to day interaction with clients – but only 27% of NA and 26% of UK use this data on a monthly basis. Just 33% of NA and 31% of UK take a monthly look at information to inform cash flow, insight which is now vital as recessionary trends escalate.

Budgeting (32% NA and 26% of UK monthly) and forecasting information (31% of NA and 28% of UK monthly) is also underused, especially in a market that is experiencing fast changing client behavior and cost pressures. Just 32% of NA and 26% of UK firms use data to inform cross-sell opportunities on a monthly basis – but with both sectors and clients affected differently by the changing economic outlook, this is another key data resource that should be further explored.

These results confirm that the investment being made to collect this valuable financial information is not being maximized. None of this data is a ‘nice to have’; it should all be actionable and used continuously to achieve essential change and support effective client communication.

Exploring BI Innovation

What is holding firms back from making far more proactive use of their growing financial data resources? Investments in technology have increased over the past couple of years as firms have recognized the need for more powerful tools to delivery greater commercial insight. Over half (57% of NA and 54% of UK) have basic Business Intelligence (BI) tools in place – typically the BI tool within the PMS - but the majority recognize the need for a more powerful solution. Over two thirds (70% of NA and 65% of UK) plan to introduce an advanced legal BI system over the next two years.

This is fractionally down on last year’s results (71% of NA and 68% of UK), indicating that only minimal progress has been made over the past 12 months towards investing in more powerful tools. Firms are saying they recognize that improving both financial information and lawyer data confidence to deliver tangible improvements is a priority, but are they acting quickly enough?

Lawyers that can improve client engagement through timely, in-depth discussion of financial metrics will play a key role in minimizing profit leakage and improving working capital. Those firms that fail to collect or utilize this invaluable resource will struggle to achieve both best practice profit margins and the level of client transparency and insight driven engagement that is fast becoming the norm.

Talking Points

Firms need to think far more proactively about the value of this financial data resource and how it can be better used. Are partners actively working with teams to drive change? Do lawyers and partners have a solid understanding of what this data means and how it can be used commercially? Is the education, culture and process in place to empower the day-to-day use of this insight to reinforce profitability across the board?

For example, some clients – and market sectors – will be affected more significantly than others by the evolving economic crisis. How many firms are actively using financial data to assess client behavior – such as demand, payment and request for discounts? This insight is key to creating a far more nuanced approach to pricing that should minimize the risk of expensive write-offs. It should also highlight problems with clients early, allowing the immediate intervention that will drive better outcomes for the business.

Taken to its logical conclusion, effective use of detailed financial information will reveal the discrepancies in profitability across all clients and matters - insight that could lead law firms to take tough decisions with some big-name clients.

This was an excerpt from the report Maintaining Profitability in a Global Recession. Access the full report to dive deeper into the findings from over 800 legal management professionals: